st louis county personal property tax rate

Louis County Missouri is 2238 per year for a home worth the median value of 179300. What is the property tax rate in St Louis County MO.

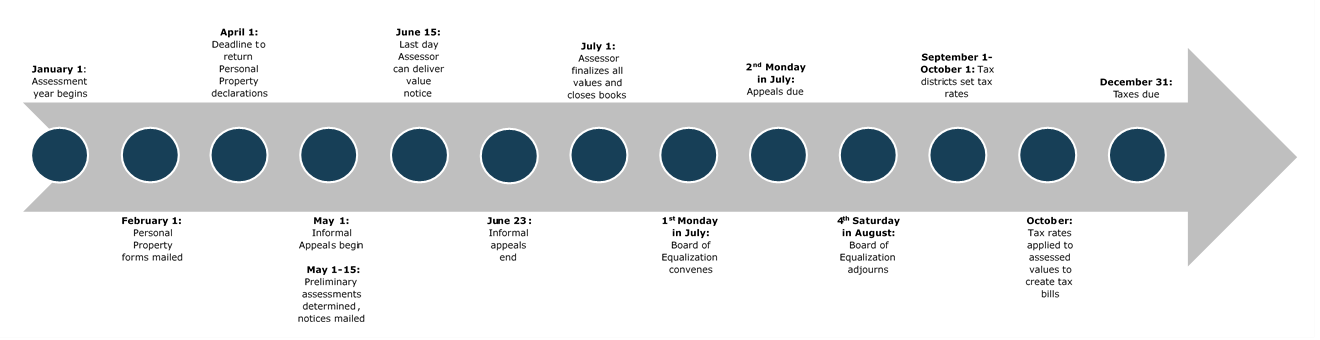

To declare your personal property declare online by April 1st or download the printable forms.

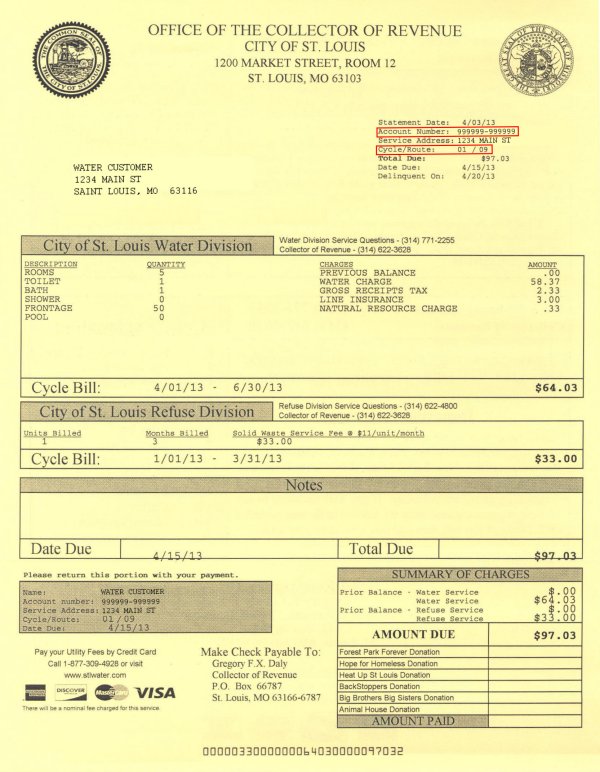

. Monday - Friday 8 AM - 5 PM. Louis County collects on average 125 of a propertys assessed fair market value as property tax. Mail payment and Property Tax Statement coupon to.

Personal property is assessed at 33 and one-third percent one third of its. PO Box 66877. On May 20 1809 Daniel Bissell took command of Fort Belle Fontaine the first military fort west of the Mississippi River.

The median property tax in St. October 15th - 2nd Half Real Estate and Personal Property Taxes are due. The median property tax in St.

Louis County Parks Cultural Sites Manager John Magurany talks about the rich colonial history youll find in North County. Louis County collects on average 125 of a propertys assessed fair market value as property tax. Property tax rates are amounts per 100 of assessed value on a piece of property.

How can I contact the Collector of Revenues Office about my annual personal property taxes. What is the St Louis county personal property tax rate. May 15th - 1st Half Agricultural Property Taxes are due.

Yearly median tax in St. Louis County Council based upon the ownership and use of the property. November through December 31st you may also drop off your payment in the night deposit box at one of four Commerce Bank locations.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Personal Property Tax Department. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

Minnesota is ranked 1326th of the 3143 counties in the United States in order of the median amount of property. Additional methods of paying property taxes can be found at. Missouri is ranked 32nd of the 50 states for property taxes as a percentage of median income.

41 South Central Avenue Clayton MO 63105. We have staff available Monday - Friday from 800 AM - 500 PM to answer calls and emails regarding your personal property tax needs. Account Number number 700280.

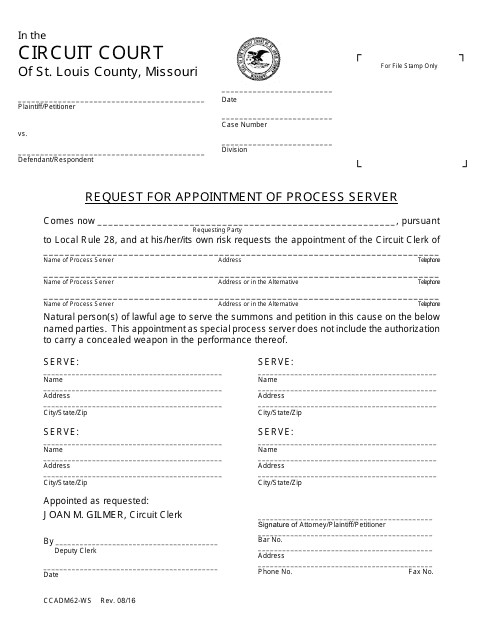

Account Number or Address. The Board of Equalizations considers requests for exemption from real and personal property taxes submitted by not-for-profit organizations and provides recommendations to the St. Monday - Friday 800am - 500pm.

Ad Find Information On Any Your County Property. May 15th - 1st Half Real Estate and Personal Property Taxes are due. Louis County collects on average 078 of a propertys assessed fair market value as property tax.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Commercial real property however includes an additional sur tax of 164 per 100 of assessed value. The median property tax on a 17930000 house is 224125 in St.

Find Your County Online Property Taxes Info From 2021. Louis County collects on average 125 of a propertys assessed fair market value as property tax. Yearly median tax in St.

If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. November 15th - 2nd Half Agricultural Property Taxes are due. August 31st - 1st Half Manufactured Home Taxes are due.

Louis City collects on average 092 of a propertys assessed fair market value as property tax. This rate applies to personal property as well as real property. Missouri is ranked 1301st of the 3143 counties in the United States in order of the median amount of property taxes collected.

Account Number number 700280. The median property tax in St. The median property tax on a 17930000 house is 163163 in Missouri.

Charles County collects the highest property tax in Missouri levying an average of 12 of median home value yearly in property taxes while Shannon County has the lowest property. The median property tax in St. Assessor - Personal Property Assessment and RecordsAssessor - Real Estate Assessment and AppraisalAssessor - Real Estate Records Summary Provides formulas used to calculate personal property residential real property and commercial real property.

To declare your personal property declare online by April 1st or download the printable forms. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes. City Hall Room 109.

Account Number or Address. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov.

The median property tax on a 17930000 house is 188265 in the United States. Louis County Courthouse 100 N 5th. Please contact us by calling 314 622-4108 or you can send e-mails to.

The exact property tax levied depends on the county in Missouri the property is located in. Louis City Missouri is 1119 per year for a home worth the median value of 122200. Louis County Minnesota is 1102 per year for a home worth the median value of 140400.

2021 City of St Louis Tax Rate 6442 KB 2021 City of St Louis Merchants and Manufacturers Tax Rate 5798 KB 2021 City of St Louis Special Business District Tax Rates 70627 KB 2021 Historical Tax Rates for City of St Louis 6867 KB. The median property tax in St.

Amazon Com St Louis County Missouri Zip Codes 36 X 48 Paper Wall Map Office Products

Print Tax Receipts St Louis County Website

County Assessor St Louis County Website

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Action Plan For Walking And Biking St Louis County Website

Collector Of Revenue St Louis County Website

Form Ccadm62 Ws Download Fillable Pdf Or Fill Online Request For Appointment Of Process Server St Louis County Missouri Templateroller

16 Expert Realtors Expertrealtors Twitter First Time Home Buyers Realtors New Construction